In the domain of accounting, the terms ‘General Ledger’ and ‘Trial Balance’ are frequently used. Yet, their distinctions and implications are often misunderstood. As a fundamental part of any business’s financial system, understanding these concepts is crucial for maintaining accurate records and making informed financial decisions. This article aims to demystify these terms, highlighting their unique roles, differences, and how each contributes to an organization’s financial health. Here’s what you need to know about general ledger vs. trial balance:

What is a General Ledger?

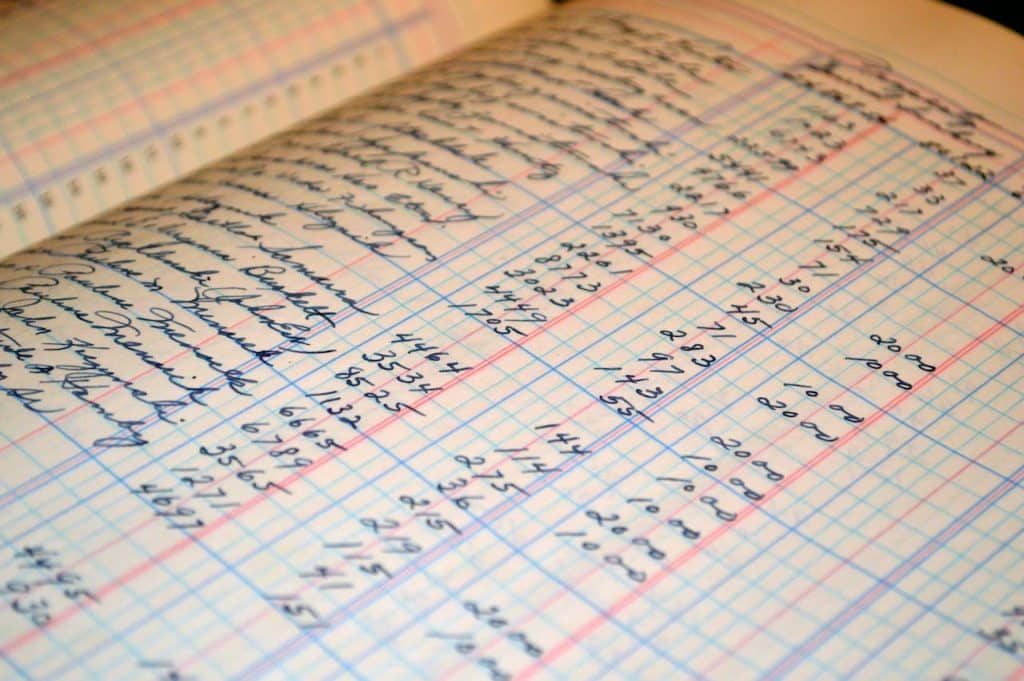

The General Ledger, often referred to as the financial backbone of any accounting system, plays a vital role in recording and tracking all financial transactions of a business. This comprehensive record is an essential tool for monitoring a company’s financial activities, ensuring accuracy and transparency.

Within the General Ledger, every financial transaction, whether it be related to assets, liabilities, revenue, or expenses, is meticulously recorded, creating a detailed account of a company’s financial landscape. Each account is assigned a unique code or number, facilitating the identification and classification of transactions.

Beyond its role in recording financial data, the General Ledger acts as the primary source of information for generating crucial financial statements such as the balance sheet, income statement, and cash flow statement. These statements provide a holistic view of a company’s financial health, enabling businesses to analyze their performance, identify trends, and make informed strategic decisions.

Furthermore, the General Ledger serves as a hub for posting and adjusting journal entries, reconciling accounts, and preparing tax returns. Its comprehensive nature ensures that all financial records are accurate and up-to-date, adhering to regulatory requirements and facilitating smooth audits.

In summary, the General Ledger serves as an indispensable resource for businesses, providing a complete and detailed picture of a company’s financial status. Its role extends beyond mere record-keeping, supporting financial analysis, decision-making, and compliance with regulatory standards.

What is a Trial Balance?

A trial balance is a crucial financial report that provides a comprehensive list of all accounts from the general ledger. It includes their respective balances, thus serving as a summary of the total debits and credits in each account. The primary objective of a trial balance is to ensure the equality of debits and credits, validating the accuracy of financial records.

By meticulously examining the trial balance, accountants can identify any potential errors or discrepancies in the general ledger before finalizing financial statements. In the unfortunate event of an imbalance, it serves as a clear indication that there might be an error in the recording or posting of transactions. Consequently, the trial balance plays a pivotal role in detecting these inconsistencies and allows accountants to make necessary adjustments, ultimately ensuring the utmost accuracy of the financial statements.

Furthermore, the importance of a trial balance extends beyond error detection. It also serves as a valuable tool in the preparation of financial statements and tax returns. Auditors heavily rely on the trial balance to verify the accuracy of a company’s financial records, ensuring compliance with regulatory standards and providing stakeholders with transparent and reliable financial information.

The trial balance acts as a fundamental component of the accounting process. Its comprehensive and detailed nature allows for meticulous error identification, adjustment, and, ultimately, the assurance of accurate financial reporting.

General Ledger vs. Trial Balance

While both the general ledger and trial balance are essential components of a company’s accounting system, they serve different purposes and play distinct roles. Here are some key differences between the two:

Purpose

The general ledger records all financial transactions, serving as a comprehensive repository of financial data. It captures every transaction, providing a complete and detailed picture of a company’s financial health.

On the other hand, the trial balance validates the accuracy of these transactions by ensuring that the debits and credits are equal. It acts as a crucial tool for error detection, guaranteeing that the general ledger is free from discrepancies.

Format

The general ledger is organized into individual accounts, each assigned a unique code or number. It allows for a systematic categorization of financial information, making it easier to locate specific transactions. Conversely, a trial balance is typically presented in a two-column format, with debits on one side and credits on the other. This clear and concise format facilitates a quick comparison to ensure that the total debits equal the total credits.

Timing

The general ledger is continuously updated, ensuring that it reflects the most recent financial transactions in real-time. It provides up-to-date information that is essential for financial analysis and decision-making.

On the other hand, a trial balance is usually prepared at the end of an accounting period, which can be monthly, quarterly, or annually, depending on a company’s accounting practices. It serves as a periodic review to verify the accuracy of the general ledger and identify any potential errors.

Level of Detail

The general ledger contains detailed information about each financial transaction, including the date, amount, and description. It offers a comprehensive and granular view of the company’s financial activities, enabling a deeper analysis of specific transactions.

In contrast, a trial balance provides a summary of the balances in each account without any additional details. It condenses the information from the general ledger, making it easier to review and detect errors without getting lost in the extensive details.

Understanding these differences is crucial for maintaining accurate financial records and making informed decisions. Both the general ledger and trial balance play integral roles in a company’s financial management, ensuring that all transactions are recorded accurately and the resulting financial statements are reliable.

Additionally, it is essential to note that while these concepts may seem straightforward, their proper implementation requires expertise and attention to detail. Therefore, businesses should invest in trained professionals or reliable accounting software to maintain accurate and efficient financial records.

With a clear understanding of the general ledger vs. trial balance, businesses can better manage their finances and achieve long-term success. So, it is crucial for companies to regularly review and reconcile both the general ledger and trial balance to ensure the accuracy of their financial records and make informed decisions based on reliable information.

Practical Applications of the General Ledger

As the primary record of a company’s financial transactions, the general ledger has many practical applications. Understanding these applications can help businesses make the most of their general ledger and improve their financial management. Here are some practical uses of the general ledger:

Tracking Expenses and Revenue

The general ledger allows businesses to track all expenses and revenue accurately, making it easier to analyze where money is being spent and how much profit a company is generating. By utilizing the general ledger effectively, businesses can identify specific areas where expenses can be reduced and revenue can be increased, ultimately improving the overall financial health and profitability of the company.

Generating Financial Statements

The general ledger serves as the primary source of information for generating financial statements such as the balance sheet, income statement, and cash flow statement. These statements provide comprehensive insights into a company’s financial performance, enabling businesses to make informed decisions about budgeting, investments, and business strategies. Having a reliable and up-to-date general ledger is crucial for accurate financial statement preparation.

Tax Preparation

The general ledger plays a vital role in preparing tax returns. By accurately recording all financial transactions in the general ledger, businesses can quickly provide the necessary information for tax reporting. This ensures compliance with tax laws and regulations, minimizing the risk of penalties or fines. A well-maintained general ledger simplifies the tax preparation process and allows businesses to meet their tax obligations efficiently.

Posting and Adjusting Journal Entries

The general ledger is used to post and adjust journal entries, which are essential for accurate financial reporting. These entries reflect any changes or corrections made to accounts, ensuring that the information in the general ledger is up-to-date and accurate. By diligently recording journal entries, businesses can maintain the integrity of their financial data and facilitate reliable reporting.

Tracking Financial Performance and Identifying Trends

Tracking financial performance and identifying trends is critical for making strategic business decisions. The general ledger serves as a valuable tool for analyzing financial data and identifying patterns or trends that can help businesses make informed decisions about budgeting, investments, and other financial matters. By leveraging the information in the general ledger, companies can gain valuable insights into their financial performance and take proactive measures to drive growth and profitability.

These examples highlight the significance of the general ledger in day-to-day accounting processes. Its accurate and up-to-date maintenance is crucial for ensuring the financial stability and success of businesses. By utilizing the full potential of the general ledger, companies can optimize their financial management practices and make informed decisions that drive long-term growth.

Practical Applications of Trial Balance

As mentioned earlier, the primary purpose of a trial balance is to detect errors or discrepancies in the general ledger. However, it also has other practical applications. Understanding these applications can help businesses make the most of their trial balance and improve their financial management. Here are some practical uses of the trial balance:

Identifying Errors

The trial balance is used to identify errors or discrepancies in the general ledger. By comparing the total debits and credits in each account, businesses can quickly detect any imbalances and investigate further to find the source of the error. This ensures that financial records are accurate and reliable.

Preparing Financial Statements

The trial balance is used to prepare financial statements accurately. By ensuring that all debits and credits are equal, the trial balance helps ensure the accuracy of the information presented in these statements. This is crucial for maintaining credibility with stakeholders and investors. Accurate financial statements provide a clear picture of a company’s financial health and performance.

Tax Preparation

Similar to the general ledger, the trial balance is also used for tax preparation. By ensuring that the balances in each account are accurate, businesses can quickly provide the necessary information for tax reporting. The trial balance helps identify any potential tax deductions or credits, ensuring compliance with tax laws and optimizing tax planning strategies.

Adjusting Entries

The trial balance is also used to make adjusting entries, which are necessary for accurate financial reporting. These entries reflect any changes or corrections made to accounts based on discrepancies found in the trial balance. By identifying adjustments that need to be made, businesses can ensure that their financial records reflect the most up-to-date and accurate information.

Auditing

Finally, the trial balance is used for auditing purposes. By verifying the accuracy of the general ledger, auditors can ensure that a company’s financial records are reliable and free from any material misstatements. The trial balance serves as evidence of accurate financial reporting during an audit, providing assurance to stakeholders and regulatory bodies.

The practical applications of trial balance highlight its importance in maintaining accurate financial records and ensuring the reliability of financial statements. Therefore, businesses should ensure that their trial balance is regularly reviewed and reconciled to identify any errors or discrepancies before they impact financial reporting. This proactive approach to financial management helps businesses make informed decisions, manage risks, and achieve their financial goals.

Conclusion

Understanding the differences between the General Ledger and Trial Balance is vital for effective financial management in any business. Both tools play pivotal roles in ensuring the accuracy, reliability, and transparency of financial records, thereby supporting informed decision-making and strategic planning. By diligently maintaining and reviewing these records, businesses can gain valuable insight into their financial health and sustain long-term success.

FAQs

What is the purpose of the general ledger and trial balance?

The general ledger records financial transactions and provides a view of a company’s financial health. The trial balance validates the accuracy of transactions, detecting discrepancies before finalizing financial statements and tax returns.

Is trial balance part of the general ledger?

No, the trial balance is a report that summarizes the balances in all accounts from the general ledger. It serves as a tool for verifying the accuracy of financial records before preparing financial statements.

What is the general ledger responsible for?

The general ledger is responsible for recording and organizing all financial transactions, maintaining accurate financial records, preparing financial statements, and assisting with audits and tax returns.

What accounts are found in the general ledger?

It contains all accounts, including assets, liabilities, revenue, and expenses. It may also include sub-ledgers for more specific categories, such as accounts receivable and accounts payable.